IRS 4952 2025-2026 free printable template

Show details

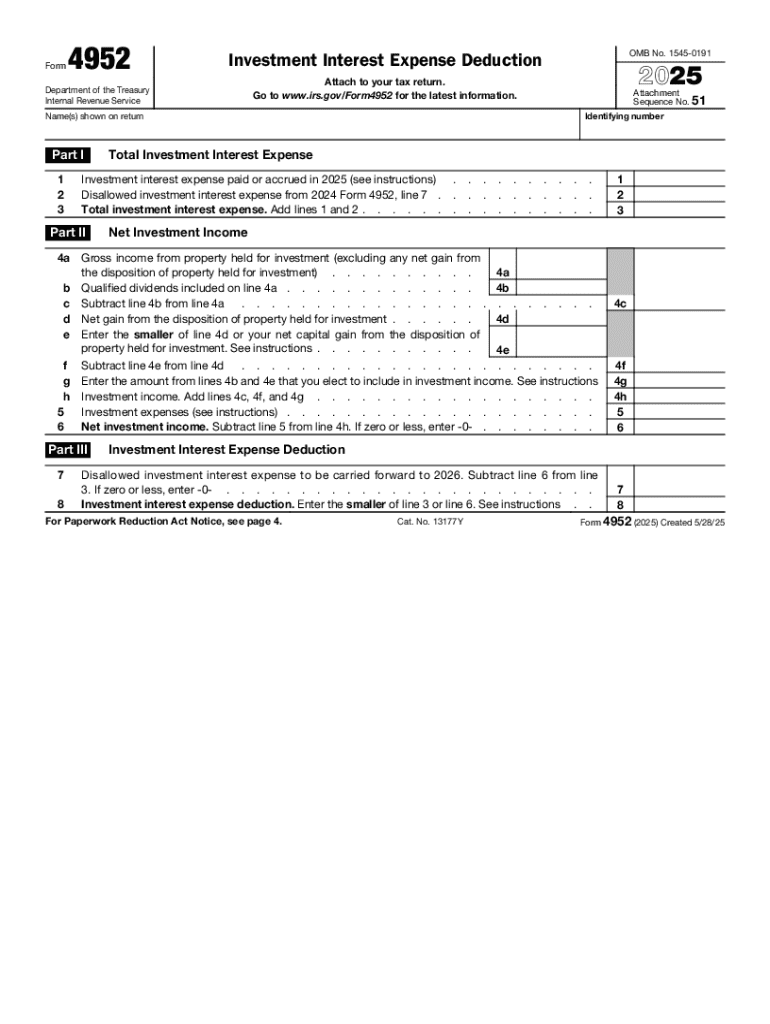

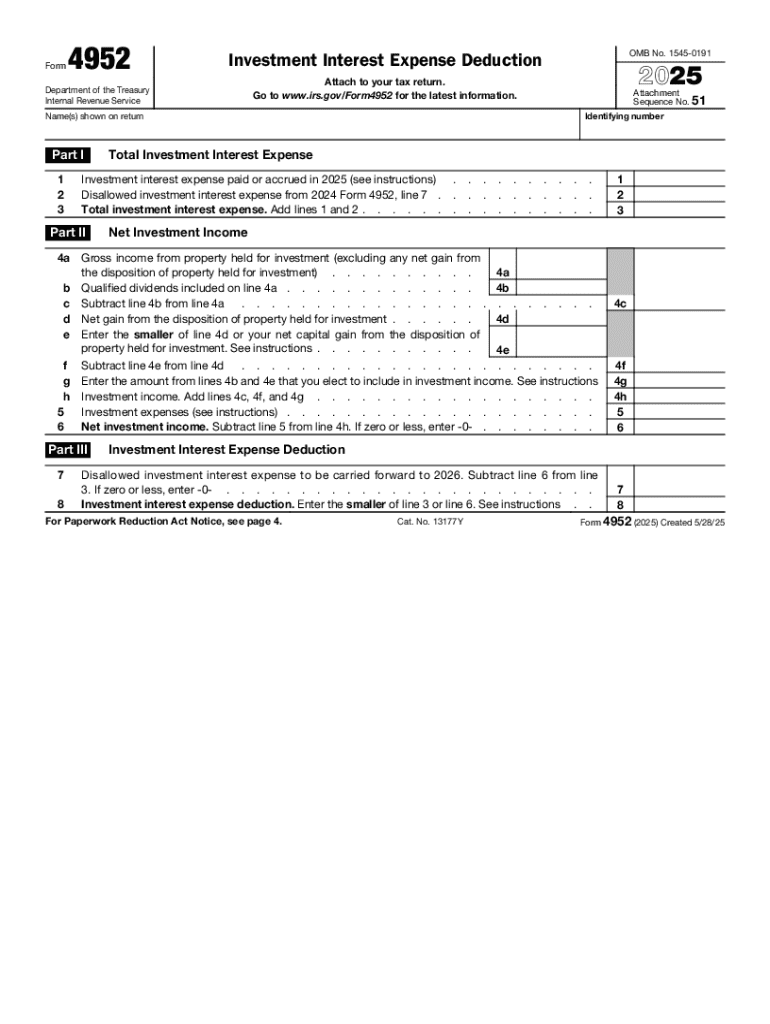

Form4952OMB No. 15450191Investment Interest Expense DeductionDepartment of the Treasury Internal Revenue Service2025Attach to your tax return. Go to www.irs.gov/Form4952 for the latest information.Attachment

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign pdffiller form

Edit your 4952 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs 4952 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 4952 online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 4952 pdf. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 4952 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out irs form 4952

How to fill out form 4952 investment interest

01

Gather all documentation related to your investment interest expenses.

02

Locate Form 4952, which is used to calculate the amount of investment interest expense you can deduct.

03

Input personal identification information at the top of the form.

04

Complete Part I by entering your total investment interest expense for the tax year.

05

Calculate your net investment income for the year in Part II.

06

Transfer the results to the appropriate line on your tax return after completing Part II.

Who needs form 4952 investment interest?

01

Taxpayers who have paid interest on loans used to purchase investments.

02

Individuals who wish to deduct investment interest expenses on their tax returns.

03

People who have investment interests that generate income.

Fill

form 4952 instructions pdf

: Try Risk Free

People Also Ask about form 4592

What qualifies as an investment expense?

An investment interest expense is any amount of interest that is paid on loan proceeds used to purchase investments or securities. Investment interest expenses include margin interest used to leverage securities in a brokerage account and interest on a loan used to buy property held for investment.

What is the 4952 election?

Form 4952 is also used to make the election to report capital gains or qualified dividends as investment income. Unless specified by the taxpayer on the form, any net capital gains are used first where the taxpayer is electing to have both capital gains and qualified dividends treated as investment income.

What is disallowed investment interest expense?

Investment interest expense limitations The IRS specifically prohibits certain types of investment interest from qualifying, including the following: qualified home mortgage interest. interest used to generate tax-exempt income, such as if you go on margin to buy a municipal tax-free bond.

What interest expense is tax deductible?

Types of interest that are tax deductible include mortgage interest for both first and second (home equity) mortgages, mortgage interest for investment properties, student loan interest, and the interest on some business loans, including business credit cards.

What are investment interest expenses?

Investment interest expense This includes the interest margin loans used to buy stock in your brokerage account and the interest on loans used to buy investment property. (This wouldn't apply if you used the loan to buy tax-advantaged investments such as municipal bonds.)

Can I deduct margin interest on Form 4952?

Investment (margin) interest deduction is claimed on Form 4952 Investment Interest Expense Deduction and the allowable deduction will flow to Schedule A (Form 1040) Itemized Deductions, Line 9 to be claimed as an itemized deduction, up to the amount of your investment income.

What qualifies as investment interest expense?

Investment interest expense is interest paid or accrued on a loan or part of a loan that is allocable to property held for investment (as defined later). Include investment interest expense reported to you on Schedule K-1 from a partnership or an S corporation.

Where do you deduct margin interest on tax return?

Correct, margin interest will still be deductible for tax year 2021 as an itemized deduction on Schedule A. However, the standard deduction has increased, meaning most taxpayers will not be itemizing deductions since claiming the standard deduction will prove more tax-efficient in many cases.

What form is deductible margin interest?

If you borrow money to purchase an investment, you may qualify for a tax break. The IRS allows certain taxpayers to take a tax deduction for the interest expense on some loans using Form 4952.

Do I need to file 4952?

Form 4952: Investment Interest Expense Deduction must be filed by individuals, estates, or trusts seeking a deduction for investment interest expenses. That means if you borrow money for an investment, you may be able to get a tax break.

Can you deduct margin interest on tax return?

If you itemize your deductions, you may be able to claim a deduction for your investment interest expenses. Investment interest expense is the interest paid on money borrowed to purchase taxable investments. This includes margin loans for buying stock in your brokerage account.

Which of the following types of interest expense is not deductible?

Types of interest not deductible include personal interest, such as: Interest paid on a loan to purchase a car for personal use. Credit card and installment interest incurred for personal expenses.

Who should use Form 4952?

Form 4952: Investment Interest Expense Deduction must be filed by individuals, estates, or trusts seeking a deduction for investment interest expenses. That means if you borrow money for an investment, you may be able to get a tax break.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 4952 instructions from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like irs form 4952 for, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send form 4952 for eSignature?

When you're ready to share your irs form 4952, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I fill out 4952 investment on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your form 4952 investment interest expense deduction instructions. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is form 4952 investment interest?

Form 4952 is used by taxpayers to calculate the amount of investment interest expense that can be deducted in a given tax year.

Who is required to file form 4952 investment interest?

Taxpayers who have investment interest expenses that they wish to deduct must file Form 4952, particularly if these expenses exceed their investment income.

How to fill out form 4952 investment interest?

To fill out Form 4952, taxpayers need to provide information about their investment interest expenses, investment income, and any carryforwards from prior years, following the instructions provided with the form.

What is the purpose of form 4952 investment interest?

The purpose of Form 4952 is to determine the allowable deduction for investment interest expense, which can help reduce a taxpayer's overall tax liability.

What information must be reported on form 4952 investment interest?

Form 4952 requires taxpayers to report their total investment interest expense, any previous carryover from prior years, and the total of their investment income to calculate the deductible amount.

Fill out your IRS 4952 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Form 4952 Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to 4952 pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.